I love living in Southern California. The weather is beautiful and sunny almost year-round, there is so much outdoor recreation to enjoy, and it’s the hub of great restaurants, entertainment and attractions to enjoy with your family.

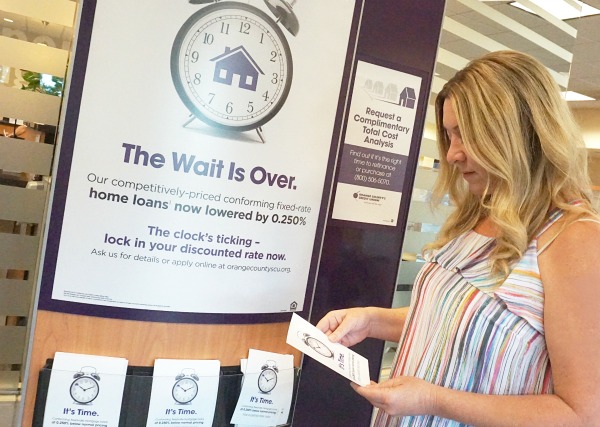

There’s also a lot to be said about settling down in Southern California with all of its amenities, including some of the top school districts in the state. With that being said, let’s talk about home buying. It’s very exciting but can also be overwhelming. Whether you’re a first-time buyer or a seasoned homeowner looking to move, with what seems to be an ever-changing housing market here in Southern California, it’s important to understand the loan and financing options available to you based on your needs and to be knowledgeable about all of your options before you start looking at properties. I was invited to Orange County’s Credit Union for a one-on-one appointment with an Orange County’s Credit Union Mortgage Loan Consultant for a complimentary Total Cost Analysis. I was excited to discuss my options in order to decide if purchasing a new home or refinancing our current home makes the most sense for our family right now.

I was invited to Orange County’s Credit Union for a one-on-one appointment with an Orange County’s Credit Union Mortgage Loan Consultant for a complimentary Total Cost Analysis. I was excited to discuss my options in order to decide if purchasing a new home or refinancing our current home makes the most sense for our family right now.

A Total Cost Analysis provides clear advice and simple side-by-side comparisons of your options, costs, and savings, all personalized to your unique needs. Here are some examples of what you’ll receive during a Total Cost Analysis:

A Total Cost Analysis provides clear advice and simple side-by-side comparisons of your options, costs, and savings, all personalized to your unique needs. Here are some examples of what you’ll receive during a Total Cost Analysis:

- a comparison of renting versus owning

- the cost of waiting so you don’t miss the right opportunity at the right time

- potential tax benefits

- your home’s equity appreciation

Orange County’s Credit Union has introduced a zero-down mortgage offering to help eliminate putting thousands of dollars down up front so I really wanted to explore that and obtain more information about the product.

For our family, we found it was more beneficial on the financial standpoint, to buy a home, rather than renting one, mainly because of the tax benefits you receive as a homeowner. With that being said, purchasing a home can also seem tricky. It can also be overwhelming. However, it doesn’t have to be. Although I’m a current homeowner, I found the process very helpful in providing me with the best information about my current options.

For our family, we found it was more beneficial on the financial standpoint, to buy a home, rather than renting one, mainly because of the tax benefits you receive as a homeowner. With that being said, purchasing a home can also seem tricky. It can also be overwhelming. However, it doesn’t have to be. Although I’m a current homeowner, I found the process very helpful in providing me with the best information about my current options.

Know Before You Go

Here’s a helpful list of items to gather before your own Total Cost Analysis Appointment. For purchase, you can get started with as little as the proposed purchase price and amount of your down payment.

If you’re a current homeowner, some recommended items include:

- Current Mortgage Statement

- Homeowner’s Insurance Declarations page

- Property Tax bill

It’s important to work with someone you can relate to and build trust with when you’re going through the home-buying process. That’s why having a trusted partner, such as one of the Mortgage Loan Consultants at Orange County’s Credit Union, who is local, experienced, and accessible will provide the guidance and peace of mind you need to obtain the home loan that meets your needs. If you’re considering either purchasing a home or refinancing your own, I’d definitely recommend a visit to Orange County’s Credit Union for your own Total Cost Analysis. To save time, this can also be done right over the phone. In addition to great rates and loan products, a Membership there also provides so many other benefits. You’re eligible for Membership if you live or work in Orange or Riverside Counties or the neighboring communities of Long Beach, Lakewood, Cerritos, or Signal Hill. If you don’t live or work in the area, you may also qualify through your employer or if your immediate family member already banks with them. Orange County’s Credit Union offers all the services you’d want from a bank, but it’s owned by Members, not shareholders.

It’s important to work with someone you can relate to and build trust with when you’re going through the home-buying process. That’s why having a trusted partner, such as one of the Mortgage Loan Consultants at Orange County’s Credit Union, who is local, experienced, and accessible will provide the guidance and peace of mind you need to obtain the home loan that meets your needs. If you’re considering either purchasing a home or refinancing your own, I’d definitely recommend a visit to Orange County’s Credit Union for your own Total Cost Analysis. To save time, this can also be done right over the phone. In addition to great rates and loan products, a Membership there also provides so many other benefits. You’re eligible for Membership if you live or work in Orange or Riverside Counties or the neighboring communities of Long Beach, Lakewood, Cerritos, or Signal Hill. If you don’t live or work in the area, you may also qualify through your employer or if your immediate family member already banks with them. Orange County’s Credit Union offers all the services you’d want from a bank, but it’s owned by Members, not shareholders.

If you’re considering either purchasing a home or refinancing your own, I’d definitely recommend a visit to Orange County’s Credit Union for your own Total Cost Analysis. In addition to great rates and loan products, a membership there also provides so many other benefits. Orange County’s Credit Union offers all the services you’d want from a bank, but it’s owned by Members, not shareholders.

If you’re considering either purchasing a home or refinancing your own, I’d definitely recommend a visit to Orange County’s Credit Union for your own Total Cost Analysis. In addition to great rates and loan products, a membership there also provides so many other benefits. Orange County’s Credit Union offers all the services you’d want from a bank, but it’s owned by Members, not shareholders.

I’m also hosting a giveaway for one of my lucky readers to win a $200 Crate and Barrel gift card! To enter, go here. This giveaway will be open until Dec. 4. One winner’s name will be chosen at random. The prize will be mailed to the winner and has no cash value. The odds of winning depend on the number of qualified entries received. One entry per person, per day. Must be a current legal resident of the Continental U.S. and be 18 years or older to enter. No purchase necessary to enter. Crate and Barrel is copyrighted. All rights reserved. Crate and Barrel is not a participant or sponsor of this promotion. Click here for full sweepstakes rules.

To request your own Total Cost Analysis or learn more about home loans, call a Mortgage Loan Consultant at (800) 506-5070.

For more information about Orange County’s Credit Union or to find a location nearest you, please go here or call (888) 354-6228.

You can connect with OC’s Credit Union on Facebook and Instagram.